-

Abbey Barn Park, High Wycombe

1 and 2 Bedroom homes available to reserve off plan today

In partnership with award-winning Berkeley Homes.

56 thoughtfully designed Shared Ownership homes on the outskirts of popular market town of High Wycombe.

-

Weavers Gate, Codicote

Enjoy village life in Codicote

One Bedroom Apartments and Two, Three and Four Bedroom houses available to reserve now.

Register your interest for our on site launch event later this month.

-

Parkside, Watford

85% Now sold

Ready to move into with deposits starting from under £5,000! Book your appointment and come and take a look at our superb 1, 2 and 3 bedroom apartments.

-

Ready to move into

Taylor Point, Watford

A selection of 1 and 2 bedroom apartments available through Shared Ownership. Register your interest and come along to our next open day to find out more.

-

Lyndhurst Farm, Borehamwood

Coming Soon

Launching Summer 2026.

1,2,3 and 4 bedroom homes available with Shared Ownership.

Register your interest here.

If you're looking for an affordable entry into home ownership, we have something for you.

learn more about Shared Ownership here

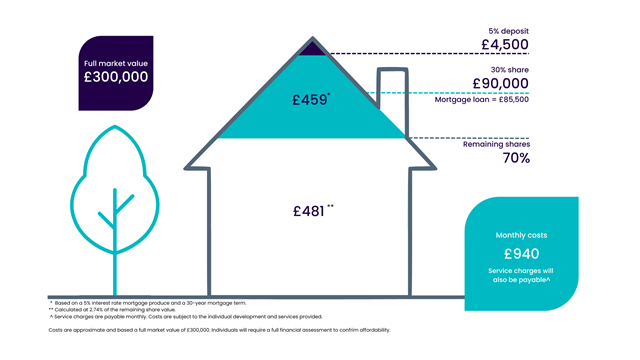

Shared ownership is a part-buy/part rent scheme, which helps you to get a foot on the housing ladder by purchasing shares in a home.

- Part-buy - you choose the amount of shares you want to buy, based on what you can afford. Shares usually start at 25% and go up to 75% of the full market value. You will normally need to obtain a mortgage for your share. You can choose to purchase more shares in the future until you own 100% of the property, this is known as staircasing.

- Part-rent - you will be charged a subsidised rent on the remaining share.

- Deposits - most buyers will use a mortgage to buy their share, this will include paying a deposit. A deposit can be as low as 5% of the share that is being purchased, which makes it more accessible for those who can't afford a deposit on the full market value.

Thrive Homes has a number a great choice of properties currently available for sale through Shared Ownership. Thrive offers an initial 990 year lease on all of our Shared Ownership homes.

To be eligible for shared ownership you must:

- earn under £80,000

- not be an existing homeowner, or be in the process of selling your current home

- be able to afford all the associated costs with owning a home.

Some of our homes may require you to meet certain criteria for example have a connection to the local area, this information will be provided per development.

All customers who wish to purchase a Shared Ownership home will need to complete a financial assessment to ensure the chosen home is affordable. The Thrive sales team will guide you through from your initial first inquiry right through to move in day!

Hear from some of our buyers

-

We couldn't believe Thrive could offer us exactly what we needed

After exploring various options to buy including moving out of the area, Suzanne and her husband came across a refurbished home for shared ownership from Thrive Homes.

-

Making homes accessible to families in Burnham

With all of the townhouses available through the government's shared ownership scheme, first-time buyers have been provided with access to a family home in an area that would otherwise be unaffordable.

-

I’ve moved five times in the last five years, and it is nice to know that I can now be settled

Chris, who is self-employed and works in the arts sector, had previously moved five times in as many years whilst living in rental properties, before finding the perfect Shared Ownership property for him.

-

Shared Ownership helped me buy a home in my local area

Knowing she wanted to remain in the local area where her children are at school, Joanne found a route into affordable homeownership through Thrive's Shared Ownership Refurbishment Programme.

-

What deposit do I need to purchase a Shared Ownership Home?

Generally, applicants will require a minimum 5% mortgage deposit of the share they wish to purchase however it is important that you speak to an Independent Financial Advisor since this can vary depending on your current circumstances and mortgage lender requirements.

-

Can I make an offer on the property different to the advertised price?

Shared Ownership prices are non-negotiable and will therefore be sold for the price advertised.

-

Do I have to buy the minimum share advertised?

We always encourage applicants to maximise on their affordability. On this basis, purchasing a larger share than the share advertised is permitted up to a maximum 75% initially as long as it’s affordable and you still meet shared ownership affordability (and mortgage lender affordability).

-

Am I eligible if I already own a home?

You can still apply for a shared ownership property if you are a current homeowner and your home is sold subject to contract - you will need to provide evidence of this. Sales must complete simultaneously if your existing home has not completed prior to the sale of your new purchase as you cannot own two homes at once as per shared ownership guidelines.

-

I have a mortgage decision in principle. Why do I need to complete an affordability check?

All Shared Ownership applicants must meet shared ownership affordability as per Homes England government requirements. This affordability check must be carried out irrespective of being in receipt of a mortgage decision in principle. This check helps to determine the maximum share affordable. The shared ownership affordability check does not consist of any credit check and will not affect your credit score.

-

When I’m applying for my mortgage, can I use my own mortgage broker or can Thrive suggest one?

Yes, you can use your own mortgage broker or go to a lender directly for your mortgage. For your initial affordability assessment however, we will require you to speak to an independent mortgage broker firm we work closely with. They are also experienced in Shared ownership mortgages although you are not obligated to use their services when it’s time to apply for a mortgage.

-

What happens if the mortgage valuation comes back as less than the sale price?

This is not common however if it occurs for any reason, the sale price will remain the same so it will be best to seek advice from your mortgage broker/lender regarding your options.

-

Are the properties leasehold or freehold?

Whilst you are a shared owner the property will be sold on a leasehold basis. If the property is a house and you staircase to 100% ownership, the lease term will fall away as the property will then become freehold. Apartments/flats will always remain as leasehold properties.

-

What is the lease term?

All new shared ownership homes are offered on a 990 year lease.

-

How will you allocate the properties to applicants if you receive multiple applications on one unit?

We allocate our shared ownership homes based on certain factors i.e financial affordability, applicants with a local connection to the area where the property is situated, Council/Housing association tenants on a secured tenancy, MOD personnel. This can differ from one development to another.

-

Do I need to find my own solicitor or can Thrive suggest one?

We have a panel of recommended solicitors however you are not obligated to use them and are free to find your own solicitor should you wish too. Shared ownership is a specialist product which is why we will be happy to provide a panel of recommended solicitors due to their extensive experience in Shared ownership conveyancing.

These solicitors act independently and are not directly affiliated with Thrive in anyway. We always ask that you do your own due diligence on the solicitor you decide to use and check their review ratings via trust pilot.

-

If I need to withdraw from the purchase of the property for any reason what happens next?

As per the terms outlined on the reservation form, if you need to withdraw after the sale has been instructed the reservation fee will be non-refundable. If your mortgage is unable to proceed for reasons out of your control, we will provide a partial (50%) refund of your reservation fee. Please note that if your mortgage fails due to you failing to disclose information the reservation fee will be non-refundable.

-

Will Thrive Homes contribute to any of the fees I may have incurred up until the point of withdrawal?

Thrive will not be liable for any costs incurred if you decided to withdraw from the sale at any point prior to the sale exchanging/completing. It is important to consider all related costs before proceeding to purchase a property.

-

What if my mortgage lender withdraw the mortgage offer after I have exchanged contracts?

This is extremely rare. In the very unlikely event that it occurs it may be due to the lender running a refreshed credit check for which adverse credit has been identified. It will be your responsibility to ensure your credit is not adversely affected during the buying process.

-

When can I move in?

If the property is not yet build complete at the time of reservation, you will be expected to work towards exchange of contracts within the set timeframe and completion would then be on notice. This means that once the properties are build complete and handed over to Thrive Homes we will in turn notify solicitors and you will then be required to complete within 2 weeks from receiving this notice.

-

What happens on completion day?

On the agreed day of completion it is important to note that the time of completion cannot be predicted as it depends purely on banking systems and when completion funds land into our solicitors account on the day. It will typically take place at some point during the working day between 9am-5pm. Once Thrive solicitors notify us, we in turn notify our sales agents who will then call you to arrange a time to carry out the key handover with you.

-

Should I give notice to my current landlord once I’ve reserved the property?

It is never advisable to give notice on your current rental property until the sale of the property you are buying has reached the point of exchange of contracts with a confirmed completion date agreed by all parties. You should always seek solicitor advice before handing in notice on a rental property and consider the likelihood of a possible crossover and any financial implications.

-

What costs are typically associated with purchasing a shared ownership property?

Below is a list of costs to consider when purchasing a Shared Ownership property although this list is not exhaustive:

• Reservation Fee

• Mortgage/IFA fees

• Solicitor fees

• Moving costs

• Stamp-duty (always seek advice from your solicitor as we are unable to give stamp duty advice)Please remember - You should only proceed to purchase a property if it is financially viable for you.

-

Will the rent I’m paying on the unowned share and the service charges be fixed?

The rent and service charges are reviewed annually and are subject to annual increases.

-

I’m buying one of the properties and would like to organise a Homebuyer’s survey – is this possible?

Due to the fact the property is new and will have undergone numerous inspections and checks we are not obliged to accommodate independent company snagging inspections. New build properties undergo numerous rigorous checks prior to being handed over. Thrive Homes also have the opportunity to inspect the property prior to us agreeing to accept handover of the properties from the developer. At these inspections, we do not expect to find any major defects however as the building is effectively man-made, it is not entirely unusual for minor defects to be picked up on occasion. You will also have a 12-month defect warranty period that begins from the date the property is handed over to Thrive during which time you can report any further defects you may have noticed. This process will be explained during your home demonstration. If you choose to proceed with an application you would be doing so on the basis of the above.

-

Can I decorate my shared ownership home once I’ve completed on the sale?

You are permitted to carry out decorations to the property i.e painting, hanging up shelves etc although we recommend you allow your new property to settle for least one full year before carrying out such decorations.

-

How about if I want to make alterations to my shared ownership home once I’ve completed on the sale?

For any alterations, requests must be put in writing to Thrive for review before a decision will be provided. Please note that request which are submitted after sales completion will be subject to an administrative fee.

-

Who is the warranty provider for the development?

NHBC

-

How do we begin the process of applying?

Please register your interest. Thrive Homes will be in touch with a launch date for prices and further information at the end of October 2023 when homes will be available to reserve.

-

Are there any flooring such a carpet or floors?

Yes, laminate, carpet & tiling finishes will be provided. Please check the brochure for further details.

-

Can you request flooring instead of carpet throughout the property at an additional cost?

Properties are sold as advertised. The specification is part of the build contract and cannot be changed as materials have already been sourced. Note there can be some material changes that differ from the specification and images within the brochure.

-

Can freehold be transferred to the buyer if able to staircase/buy a hundred percent?

For houses, yes the freehold will be transferred to you at the point of 100% staircasing/ownership. For flats, at 100% ownership, the leasehold title remains in your name but your shared ownership obligations will fall away.